us japan tax treaty article 17

C the terms a Contracting State and the other Contracting State mean Japan or the United States as the context requires. The proposed new treaty will make an overall revision of the treaty between the two countries which was put in place in.

Simple Tax Guide For Americans In Japan

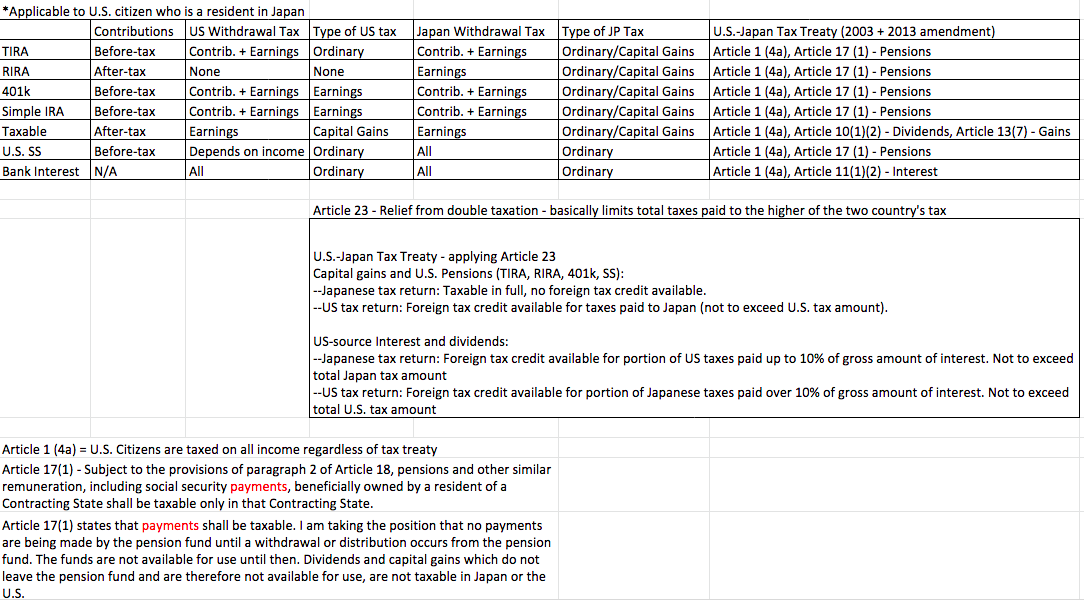

Lets take a look at how the US and Japan tax treaty impacts pension.

. Article 4-----General Treaty Rules Article 5-----Avoidance of Double Taxation. Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments. The proposed treaty is similar to other recent US.

Tax treaty with the United States contains a Limitation on Benefits article are eligible for benefits only if they satisfy one of the tests under the Limitation on Benefits article. The interventions focussed on the suggestion to include a rule under de minimis which low-income earners would be exempt from the application of Article 17. Article 17 of the US-Japan Tax Treaty clearly states.

Japan - Tax Treaty Documents. Resident in either Japan or the United States. UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28.

Entry into effect a the provisions of the mli shall have effect in each contracting jurisdiction with respect to the tax treaty between japan and the united arab. Changes to Article 17. Article 5 of the United States- Japan Income Tax treaty defines permanent establishment as a fixed.

Japan is a member of the United Nations UN. It does not apply to a US Citizen or Permanent Resident. 3 Relief From Double Taxation.

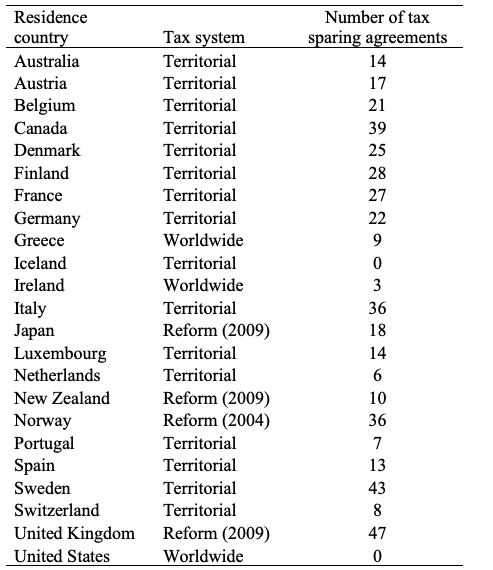

This table lists the income tax and. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. The concept of permanent establishment is a key term to this and any bilateral tax treaty.

Citizens living in Japan. Japan is also one of the United States longest. D the term tax.

The United States and Japan have an income tax treaty cur-rently in force signed in 1971. 2 Saving Clause and Exceptions. Under these treaties residents not necessarily citizens of foreign countries are taxed at a.

Technical Explanation PDF - 2003. Article 17 of the US-Japan Tax Treaty clearly states. Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments.

1 JANUARY 1973. Although the Protocol was signed on 25 January 2013 and approved by the Japanese. Japan - United States Tax Treaty.

Article 4 sets forth the rule that a resident of one state may be. Each prefecture is overseen by a governor. The proposed treaty would replace this treaty.

Therefore if a US person earns. Therefore if a US person earns public pension from work performed in Japan then they can claim that it is only taxable in Japan. Income Tax Treaty PDF - 2003.

The United States has income tax treaties with a number of foreign countries. US-Japan Tax Treaty. Article 17 of the US-Japan Tax Treaty clearly states.

Protocol PDF - 2003. 4 Income From Real Property. 1 US-Japan Tax Treaty Explained.

Us japan tax treaty article 17. Japan is comprised of 47 prefectures and eight regions. Any other United States possession or territory.

Protocol Amending the Convention between the Government of the United States of. On 25 January 2013 24 January US time the governments of Japan and the United States signed a new Protocol to.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Us Tax Tips For American Expats Who Retire In Japan Bright Tax

Tax Free Withdrawal Of Us Based Retirement Funds Sf Tax Counsel

List Of Tax Treaties Concluded In The Period 1970 1989 In Download Table

Administration Of Double Tax Treaties

Tax Sparing Agreements And Foreign Direct Investment In Developing Countries Austaxpolicy The Tax And Transfer Policy Blog

The Complete J1 Student Guide To Tax In The Us

Japan United States International Income Tax Treaty Explained

Let S Talk About Us Tax Implications Of The Malta Treaty Htj Tax

U S Tax Treatment Of Chinese Mandatory Individual Accounts And Social Insurance Pensions Castro Co

U S Expat In Japan With Japanese Spouse Pre Post Retirement Taxation Bogleheads Org

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Australia Japan To Sign Security Cooperation Treaty Reuters

Full Article The Rise Of China And Contestation In Global Tax Governance

United States Taxation Of International Executives Kpmg Global

When Does The Ch Us Tax Treaty Apply To Us Citizens Kpmg Schweiz

Pillar 1 Tax Treaties And Congressional Approval

Nonprofit Law In Japan Council On Foundations

The Benefits And Limitations Of Tax Treaties When Financing Cross Border M A Vistra